Learn the differences between bronchoscopy and endoscopy, including what each procedure entails and...

Read More

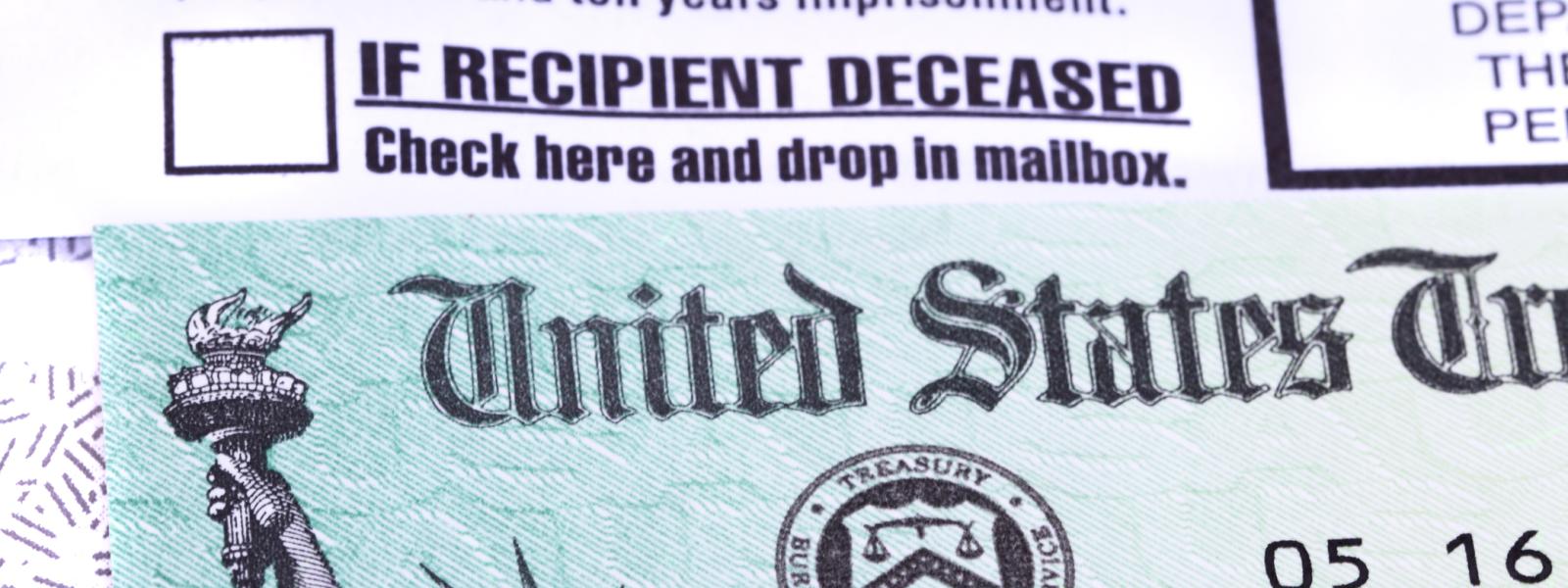

As of March 2023, over 65 million people are enrolled in Medicare. As that number grows, the threat of Medicare fraud increases as well. Understanding the common issues people face and learning to spot fraudulent activities will help protect yourself if fraud comes knocking at your door.

Medicare fraud takes various forms, including identity theft, billing scams and prescription fraud. Fraudsters often target unsuspecting individuals, exploiting their trust in the health care system for financial gain. According to the Federal Trade Commission (FTC), Medicare fraud costs taxpayers billions of dollars each year, making it imperative for individuals to stay vigilant.

Medicare fraud is a pervasive issue that requires proactive measures from beneficiaries. Being informed and vigilant is the first line of defense.

One common fraud tactic involves health care providers billing Medicare for services that were never provided. Beneficiaries may receive statements for treatments or medications they never received, resulting in financial loss and potential harm to their medical records.

Fraudsters may steal Medicare numbers, leading to unauthorized billing or even the creation of fake services. Victims of identity theft can face financial repercussions and the risk of incorrect medical information being added to their records.

Scammers often use unsolicited phone calls, emails or door-to-door visits to offer fake services, such as free health check-ups or equipment. Falling for these schemes can result in providing personal information or being enrolled in unnecessary programs.

Seniors are particularly vulnerable to these scams due to their reliance on health care services. You should always be skeptical of unsolicited offers and verify the legitimacy of communications.

Check your Medicare statements regularly for any unfamiliar charges or services. If you notice discrepancies, report them immediately to Medicare. Refuse delivery of medical items you did not order.

Be cautious about sharing your Medicare number and other personal information. Don’t give your information to people who ask for payment over the phone or the Internet. Only provide it to trusted health care providers; never disclose it to unknown individuals or entities.

Before receiving any services, confirm the legitimacy of health care providers and check their credentials. Contact Medicare to ensure they are authorized. Coordinate your medical care through your primary care provider when possible and do not respond to advertisements offering medical services for free or with no out-of-pocket cost.

The best defense against Medicare fraud is an informed and vigilant beneficiary. Regularly reviewing statements and safeguarding personal information are simple yet effective practices.

Protecting yourself from Medicare fraud requires awareness, vigilance and proactive measures. You can safeguard your health and financial well-being by understanding common issues, spotting potential scams and promptly reporting any suspicions. Stay informed, stay vigilant and empower yourself against the threat of Medicare fraud.

If you suspect Medicare fraud, report it promptly. Contact Medicare at 1-800-MEDICARE (800-633-4227) or report online through the official Medicare website. You can also notify the FTC through their website or by calling 1-877-FTC-HELP. Inspira’s compliance hotline is 1-888-413-4313.

Inspira Health is a high reliability organization (HRO), which means safety is the top priority for patients and staff. To make an appointment, call 1-800-INSPIRA.

Learn the differences between bronchoscopy and endoscopy, including what each procedure entails and...

Read More

Many take daily vitamins for hair growth and digestion, but do they work? Most diseases treated by...

Read More

Are you concerned about being underweight? While much attention is placed on the health risks of...

Read More

The material set forth in this site in no way seeks to diagnose or treat illness or to serve as a substitute for professional medical care. Please speak with your health care provider if you have a health concern or if you are considering adopting any exercise program or dietary guidelines. For permission to reprint any portion of this website or to be removed from a notification list, please contact us at (856) 537-6772